Winter Market Update

Winter Market Update

November 2022

So far, in 2022, Steffes Group has conducted 530 auction sales in 10 states, giving us a unique perspective of the machinery and rural real estate markets. We have been in the auction business for nearly 63 years and, as a company, have witnessed many cyclical changes that drastically impacted machinery and land values. Depending on who you talk to, most would tell you the cycle we are in now has been the most remarkable and perhaps one we will never see again in our lifetime.

Perspective

Six short years ago, we were asking ourselves who we were going to find to buy the glut of equipment we had available on our upcoming auction sales. Dealer lots were full. Land values had dropped up to 50% in some places compared to their highs in 2013. In some cases, units with only a few hundred hours of total time hardly fetched half the new price. It was a market where bidders and buyers were in the driver's seat. Fast forward to the present day, and it's hard to imagine a world with more contrast to where we were. Well-cared-for used equipment has reached prices seen for new equipment six years ago. Land values have eclipsed their previous highs, and it is almost entirely a seller's market on both the land and equipment fronts.

In some cases, equipment isn't even available for 2-3 years. Manufacturers are backlogged with orders as they navigate supply chain issues and the spike in demand created by the COVID-19 pandemic and associated relief money. Indeed, some of the present issues can be attributed to fiscal policy and related relief funds. We also point to our three leading indicators, which have been gospel for us through the years.

Leading Indicators

- Commodity Prices

- Interest Rates

- Yields

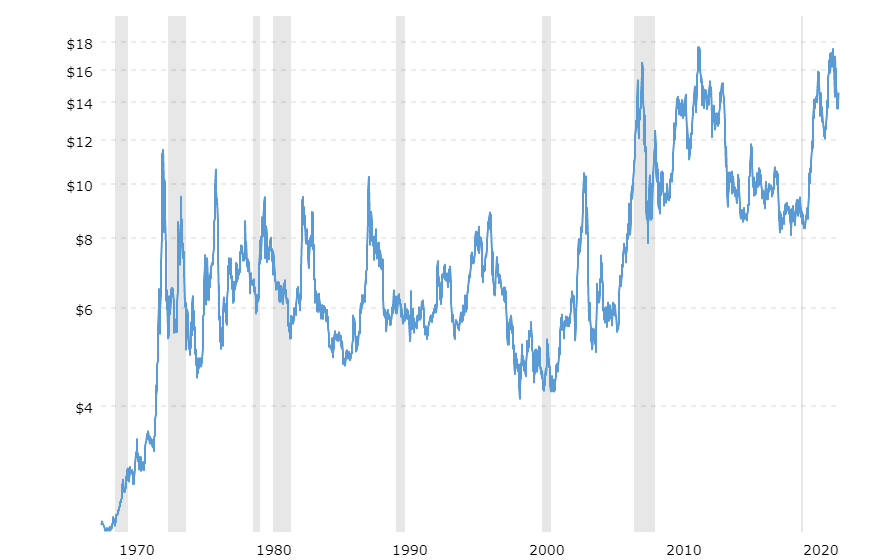

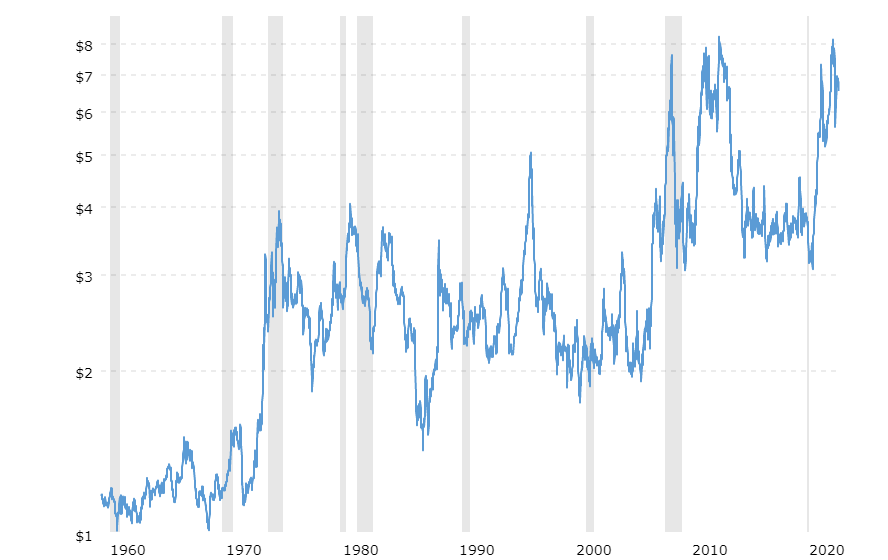

Commodity prices have and always will trump all other factors influencing machinery and land prices. Comparing the land and machinery market lows and our present market next to the historical commodity prices illustrates this almost perfectly.

Photo Caption: Chart of historical daily soybean prices back to 1971.

Photo Caption: Chart of historical daily corn prices back to 1959.

Other factors include interest rates and yields which, from a macro perspective, appear to be measuring up to be average to good.

Land

On the land front, things have been stronger than anticipated this fall, with rising rates having little effect on the prices realized at our auction sales for good-quality cropland. Overall, farmers are still typically outbidding investors. Bidder registration remains strong on our auction sales with good interest from farmers and outside players. It has not been uncommon for us to see more than twenty-five registered bidders on a single quarter or 80 of land, which in the past was very rare.

"The Gates Effect"

We anticipate the strong interest in land as an investment to continue as the press continues its fascination with the ultra-wealthy's purchase of farmland. Of course, it's nothing new if you're a student of history. Royalty and monarchs of yesteryear long ago figured out that land was a good store of wealth, and farmers have known it since the homestead days. High-profile purchases, however, have attracted other wealthy individuals to the land market. The farmland market is still very local but appears to be trending more towards other real property markets, such as commercial and residential. Even compared to five years ago, sales data and information on farmland are much more widely available and easily accessed. Look to see this trend continue as big tech and data remain king, giving resources to those unfamiliar with production agriculture and farm real estate.

Moving Forward

As we step into our winter selling season, we're predicting a continuation of what we have seen with some caveats. The appreciation we saw earlier this year and throughout last year appears to be slowing. It's important to remember how radical the climb has been. While we are still anticipating some very strong prices, we don't anticipate record prices being as numerous as last spring and fall.

According to our dealership friends, there isn't much sign of that slowing into 2023 as the supply chain issues won't be worked through until 2024 at the earliest. On the construction front, the same will likely hold true. Any fiscal spending aimed at improving America's infrastructure will no doubt trickle into the construction equipment markets, where there is already a shortage of supply. If you're on the buying side, don't wait to fulfill any equipment needs, even if current prices are hard to stomach. There is little reason to believe equipment will be cheaper anytime soon.

If you're a seller or are considering retiring, I will tell you there is a tremendous demand for equipment and land. Moreover, the cash rent market is incredibly strong, with many aggressive farmers anxious to rent additional acres. If you're ready, it is a fantastic time to exit. For nearly 63 years, we have been providing auction services, and we would love to be of service to you if any of those are in your plans.

Max Steffes | Steffes Group, Inc.

West Fargo, ND